The model we run is this

library(forecast)

library(ggplot2)

# Create sample data

set.seed(123)

n <- 120

time <- 1:n

# Main time series with trend + seasonality

y <- 50 + 0.3*time + 10*sin(2*pi*time/12) + rnorm(n, 0, 5)

# External variable (e.g., marketing spend)

x1 <- 20 + 0.1*time + rnorm(n, 0, 3)

# Convert to time series object

y_ts <- ts(y, frequency = 12)

x1_ts <- ts(x1, frequency = 12)

# Let R find optimal parameters

sarimax_model <- auto.arima(y_ts,

seasonal = TRUE,

stepwise = TRUE,

approximation = TRUE,

xreg = x1_ts)

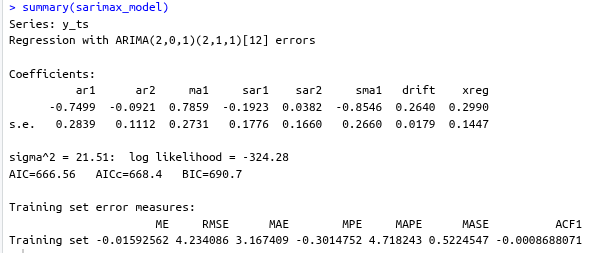

summary(sarimax_model)Now the output we get is

Interpretation

Here’s a comprehensive interpretation of our SARIMAX model output:

Model Structure

SARIMAX(2,0,1)(2,1,1)[12] with external regressor

- Non-seasonal part: AR(2) + MA(1)

- Seasonal part: Seasonal AR(2) + Seasonal MA(1) with seasonal differencing (D=1)

- Seasonality: 12 months (monthly data)

- External regressor: One predictor variable (

xreg)

Coefficients Interpretation

Non-seasonal Components:

- AR(1) = -0.75: Strong negative autoregressive effect - high values tend to be followed by low values

- AR(2) = -0.09: Weak negative second-order autoregressive effect

- MA(1) = 0.79: Strong moving average effect - shocks persist for one period

Seasonal Components (12-month cycle):

- SAR(1) = -0.19: Moderate negative seasonal autoregressive effect

- SAR(2) = 0.04: Very weak positive seasonal effect

- SMA(1) = -0.85: Strong negative seasonal moving average - seasonal shocks reverse quickly

External Effects:

- Drift = 0.26: Positive trend component (0.26 units increase per period)

- xreg = 0.30: External variable has positive effect - 1 unit increase in xreg predicts 0.30 unit increase in y

Model Quality Assessment

Statistical Significance:

- Significant coefficients: AR(1), MA(1), SMA(1), Drift (coefficient > 2× standard error)

- Borderline: xreg (2.07× SE), SAR(1) (1.08× SE)

- Insignificant: AR(2), SAR(2) (coefficient < SE)

Model Fit Statistics:

- AIC = 666.56, BIC = 690.7: Good for model comparison (lower is better)

- Log-likelihood = -324.28: Baseline for model comparison

- σ² = 21.51: Error variance

Forecast Accuracy:

- RMSE = 4.23: Average forecast error magnitude

- MAE = 3.17: Average absolute error

- MAPE = 4.72%: Excellent accuracy (error <5% of actual values)

- MASE = 0.52: Model performs 48% better than naive forecast

Key Insights & Recommendations

Strengths:

- Excellent predictive accuracy (MAPE <5%)

- Strong seasonal patterns captured effectively

- Good model fit with reasonable complexity

- External variable adds value to predictions

Concerns:

- Over-parameterization: AR(2) and SAR(2) appear unnecessary

- Some coefficients borderline significant

Suggested Improvement:

# Try simplified model

better_model <- Arima(y_ts, order = c(1,0,1), seasonal = c(1,1,1), xreg = xreg)Business Interpretation:

- The time series shows strong seasonal patterns with 12-month cycles

- There’s a positive underlying trend (0.26 units/period)

- The external variable has moderate predictive power

- Model provides highly accurate forecasts with ~4.7% average error

This is generally a good quality model that should provide reliable forecasts for business planning.